If you want to buy IDT Regular Batch : Click Here

If you want to buy IDT Exam-Oriented Batch : Click Here

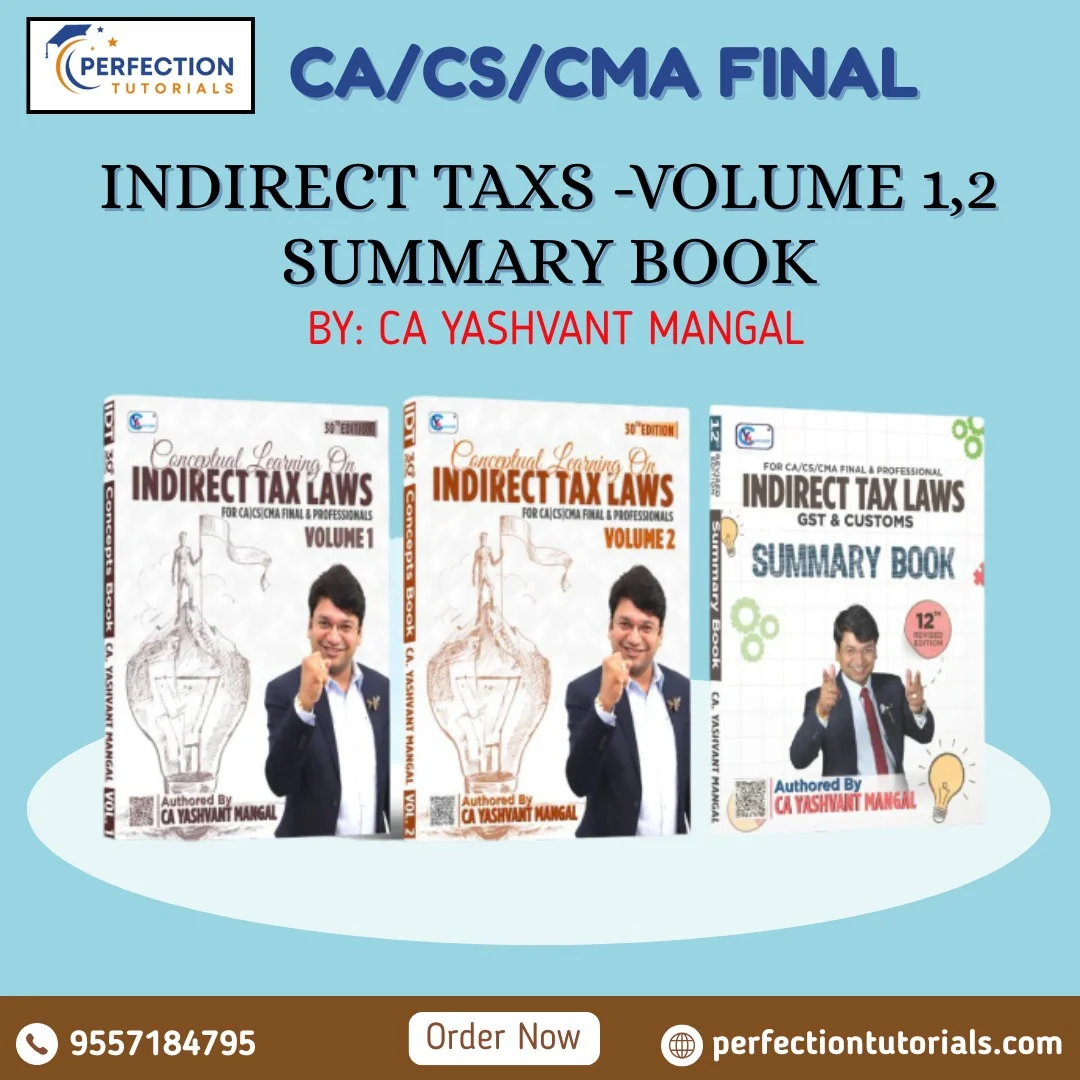

Product Info-

IDT- 30th Edition Conceptual Learning On Indirect Tax Laws (Colorful Book)

A Handbook on Conceptual Learning on Indirect Tax Laws (GST & Customs) for CA Final/ CS Final By CA Yashvant Mangal. Applicable For Sep. 25, Jan. 26, May 26 & Onwards Exams

Specials Features of this Book :-

– 2 Volumes Colorful Book

– All provisions in this book are amended by Finance Act, 2024, Notifications and Circulars made effective upto 15.05.2025.

– Every topic with its complete analysis and interpretation.

– Easy understandability through soft language.

– Solved analytical illustrations as per current amended law.

– 100% Coverage with conceptual clarity.

IDT – Colorful Summary Book 12th Revised Edition

Special Features of This Book

- Entire IDT (GST + Customs) Revision

- All provisions in this book are amended by Finance Act, 2024, Notifications and Circulars made effective upto 15.05.2025.

- Covering all topics with latest Notifications & Circulars

- Fully Colored Book with diagrams, charts and pictures.

Reviews

There are no reviews yet.