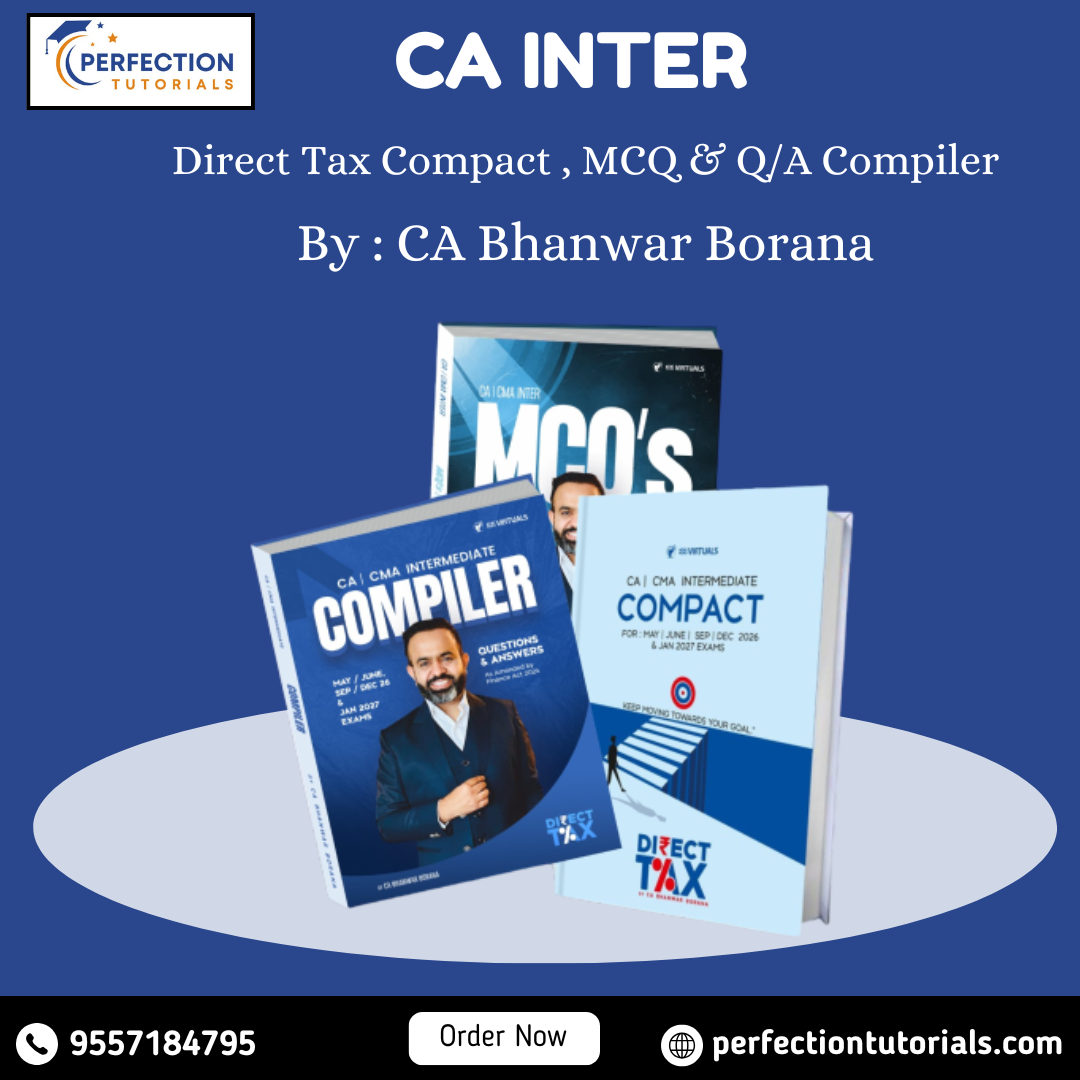

Highlights :

“COMPACT” is a Color- coded book for easy understanding

Black-Headings

Blue – Main Content

Red-Important Point &Words

Green– Amendments

Contents

1. Basic Concept

2. Residence And Scope Of Total Income

3. Incomes Which Do Not Form Part Of Total Income (Exempt Income)

4. Income From Salary

5. Income From House Property

6. Profit Or Gain From Business & Profession

7. Capital Gain

8.Income From Other Sources

9. Clubbing Of Income

10. Set Off & Carry Forward Of Losses

11. Deduction Under Section Vi – A

12. Advance Tax

13. Interest U/S 234 A/B/C/D & 244a

14. TDS

15. Provisions For Filing Return Of Income And Self-Assessment

Compiler

1. Basic Concepts & General Tax Rates

2. Residence & Scope of Total Income

3. Income which do not form part of Total Income

4. Income from Salary

5. Income from House Property

6. Profit and Gain from Business or Profession

7. Income from Capital Gain

8. Income from other sources

9. Income of other persons included in Assessee’s Total Income (Clubbing of Income)

10. Set-off & Carry forward of Losses

11. Deductions from Gross Total Income (Deduction u/c VI-A

12. Advance Tax, Tax Deducted at Source (TDS) & Tax Collection at Source

13. Provision of Return Filing & Self-Assessment

14. MCQ’s issued by ICAI

15. Part 1

16. Part 2

17. Part 3

18. Part 4

19. MCQs from RTPs and MTPS

20. Part 1

21. Part 2

22. Part 3

23. Part 4

24. Part 5

25. Series 1-4

26. Series 1

27. Series 2

28. Series 3

29. Series 4

Faculty Info :

CA Bhanwar Borana

Founder of BB Virtuals, CA Bhanwar Borana is one of India’s most trusted educators in Direct and International Taxation. With 14+ years of teaching experience, he has guided thousands of students, producing 800+ All India Rank holders. A regular speaker at ICAI and various taxation platforms, he is known for his dynamic teaching style and deep subject expertise, passionately mentoring future CAs to achieve both academic excellence and practical insights for a successful career.

Reviews

There are no reviews yet.