- DT Regular Demo Lectures By CA Bhanwar Borana : Click Here

- AFM Regular Demo Lectures By CA Sankalp Kanstiya: Click Here

- Audit Regular Demo Lectures By CA Shubham Keswani: Click Here

- If you want to buy DT Regular Batch– Click Here

- If you want to buy AFM Regular Batch- Click Here

- If you want to buy Audit Regular Batch- Click Here

Batch Info-

Batch 1 – Live for Nov 2025 & Onwards

Direct Tax

Date of Commencement: 5th August 2024

Date of Completion: 15th November 2024

AFM

Date of Commencement: 21st Mar 25

Date of Completion: 30th June 25

Audit

Live + Blended Batch

Date of Commencement: 1st April 2025

Date of Completion: 30th June 2025

100% Backup

Timings : 7 AM to 10 AM (Monday to Saturday)

Weekly tests on Sunday

New Edition Books will be dispatched from March End.

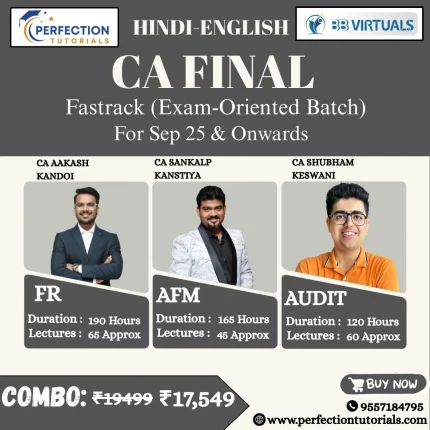

Batch 2 – Recorded for Sept’25 Exams

Direct Tax

Date of Commencement: 5th August 2024

Date of Completion: 15th November 2024

AUDIT

Sep’24 Recordings (updated with amendments)

AFM

Date of Commencement: 3rd Oct 24

Date of Completion: 31st Dec 24

100% module coverage, including RTPs, MTPs, PYQs, and ICAI MCQ case scenarios—fully updated till your respective attempt!

Product Info

Direct Tax

No of lectures- 84 Lectures Approx

Duration– 253 Hours Approx

Validity– 1 Year from the date of Activation

Views– 1.5 Times

Study Material- Bare Act Provision Book / Compact 3.0 / Q & A Compiler

Audit

Duration– 156 hours Approx.

No of Lectures– 62 Lectures

Validity– 2 Years from the date of Activation

Views– 1.7 Views

Study Material- Hardcopy of Coloured Notes & Question Bank Including MCQ’s

AFM

No of Lectures- 75 Lectures

Duration– 255 Hours

Validity– 3 years from the date of activation

Views– 1.7 Views

Study Material- (2 Volumes + 1 Magic book)

Highlights

System Requirement :

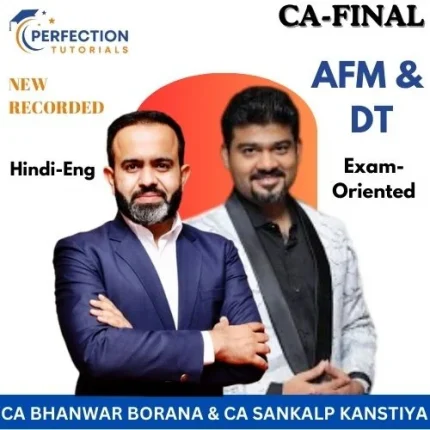

Faculty Info

CA Bhanwar Borana

Founder of BB Virtuals, CA Bhanwar Borana has given 500+ ranks in CA and gives regular lectures at ICAI and various taxation platforms with 12 years of teaching experience in IPCC and Final Direct and International Taxation exams.

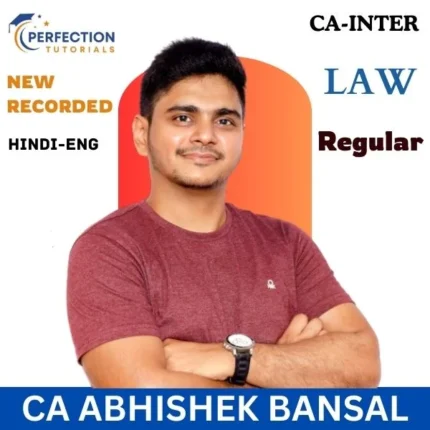

CA Shubham Keswani

CA Shubham Keswani is a Merit holder at CA Final & Inter level. He completed his 3 years of Articleship training in the field of Audit & Assurance from EY. Having secured exemption in Auditing at both levels of his CA Journey, his purpose is to enlighten you with his experience & expertise.

CA Sankalp Kanstiya

began his career at JP Morgan Chase, brings 12+ years of teaching experience, blending concepts with practical insights. Founder of a Mumbai-based educational venture, he has been a faculty at ICAI, BCAS, ICSI, and ICAI’s Live Virtual Classes.

Reviews

There are no reviews yet.